Phone Number: +1 (334) 676-1321 Toll Free Number: +1 (866) 545-8643

Expert Solutions for Financial Success

Fueling Financial Growth with Accountable Solutions and Dependable Services

Call Our Toll Free Number

About Us

Accounting services you can trust

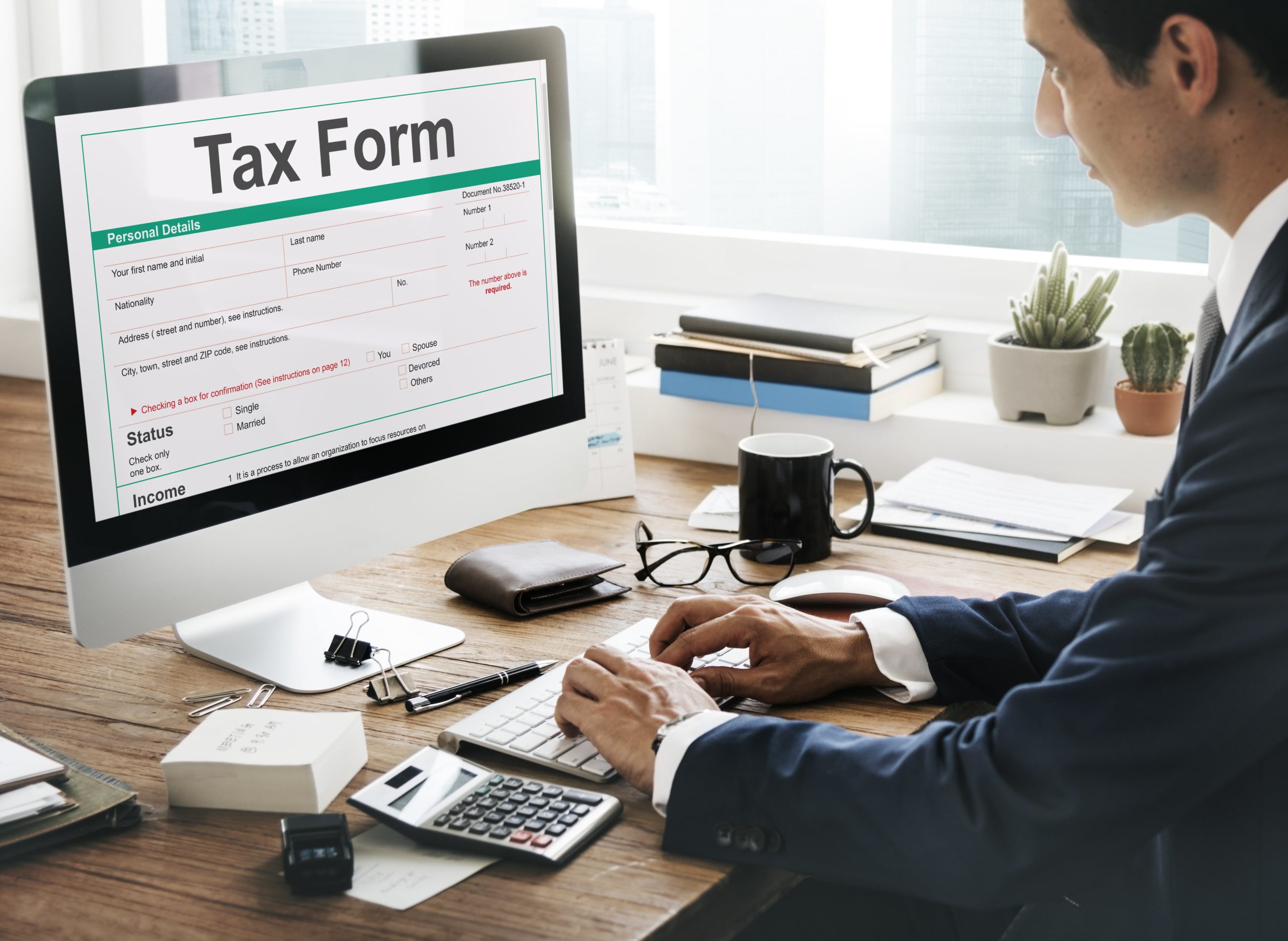

WTP accounting was started in 2006 and has been a leading business in tax preparation. We are well-versed and tax credits and Law, and CPE qualified, and we also offer online uploading of the text documents in a secure Client Portal.

At WTP Accounting Solutions, we are committed to providing comprehensive financial solutions tailored to your needs. With a team of seasoned professionals, we ensure precision in every aspect of tax preparation, payroll management, and ERC Credit services. Our mission is to empower businesses of all sizes, helping them navigate complex financial landscapes with ease. Trust us to streamline your financial processes, so you can focus on what matters most—growing your business.

Services

Form 1040 & Form 1040A

Form 1040 is the standard Internal Revenue Service (IRS) form that individuals use to file their annual income tax returns. It’s a comprehensive document that allows taxpayers to report their income, claim deductions and credits, and calculate the amount of tax they owe or the refund they can expect.

Form 1098 T

It is provided by educational institutions to students who have incurred qualified tuition and related expenses during the tax year. The form is used to report information about these expenses, which can be used by the student or their parents to claim education-related tax benefits, such as the American Opportunity Credit or the Lifetime Learning Credit, when they file their federal income tax returns.

Form 1040 EZ

Form 1040EZ is the simplest IRS tax form designed for taxpayers with straightforward tax situations. It is a shorter version of the standard Form 1040, enabling individuals with no dependents to report their income, claim deductions, and calculate their tax obligations easily.

Forms Schedule

IRS Forms Schedules are additional forms that taxpayers use to provide specific details about their income, deductions, and tax credits. These supplementary forms, such as Schedule A for itemized deductions or Schedule C for reporting business income, allow individuals to provide comprehensive information to the IRS, ensuring accurate tax reporting.

C (business profit and loss) 1099

Form 1099 is an IRS tax form used to report various types of income other than wages, salaries, and tips. It’s typically used to report income such as interest, dividends, self-employment earnings, and various other sources of income.

Form 1099 NEC

Form 1099-NEC is used to report nonemployee compensation to the Internal Revenue Service (IRS). It is typically used by businesses to report payments made to independent contractors, freelancers, and other non-employee service providers. Nonemployee compensation includes fees, commissions, prizes, and awards for services provided by individuals who are not classified as employees.

Accounting Practices

Accounting practices encompass the systematic recording, analysis, and interpretation of financial information. They provide businesses with insights into their financial health, enabling informed decision-making and ensuring compliance with regulatory standards.

Business Payroll

Business payroll refers to the process of managing and overseeing employee compensation, including wages, salaries, bonuses, and deductions. It ensures timely and accurate payment distribution, adhering to regulatory requirements and internal policies.

Tax Preparation for any state

Tax preparation for any state involves comprehensive analysis and interpretation of state-specific tax regulations. It ensures accurate filing of state taxes, compliance with regional tax laws, and optimization of available deductions and credits.

ERC Employee Retention Credit & Content

Employee retention refers to the strategies and practices implemented by businesses to retain valuable talent within their organization. It involves creating a supportive work environment, offering opportunities for growth, and recognizing and rewarding employees’ contributions.

Credit starting in the year 2020 through 2023

Credit trends from 2020 through 2023 have shown increased reliance on digital financing, rising awareness of credit scores’ impact, and a shift towards personalized lending solutions. Additionally, the global economic climate has emphasized the importance of credit management and financial resilience for individuals and businesses alike.

Services Menu

| Service | Price | Duration | Category |

|---|---|---|---|

| Form 1040 | 750.00 | 2:0 | Tax Preparation |

| Form 1040A | 750.00 | 2:0 | Tax Preparation |

| Form 1040 EZ | 150.00 | 2:0 | Tax Preparation |

| Forms Schedule | 50.00 | 3:0 | Tax Preparation |

| C (business profit and loss) 1099 | 500.00 | 0:15 | Tax Preparation |

| Form 1099 NEC | 500.00 | 0:15 | Tax Preparation |

| Accounting Practices | 50.00 | 0:15 | Tax Preparation |

| Business Payroll | 50.00 | 0:15 | Tax Preparation |

| Tax Preparation for any state | 50.00 | 0:15 | Tax Preparation |

| ERC Employee Retention Credit & Content | 50.00 | 0:15 | Tax Preparation |

| Credit starting in the year 2020 through 2023 | 50.00 | 0:15 | Tax Preparation |

| Form 1098 T | 50.00 | 0:15 | Tax Preparation |

Book Now

Contact Us

Send us a Message

Contact Info

Email Address

Location 1

631 W. Fairview Ave., Montgomery, AL 36106 suite E

Location 2

300 N Norton Ave Ave Sylacauga, Al 35150 Suite E